Sprive Cashback Retailers: Boost Your Mortgage Overpayments with Everyday Spending

Everyday Essentials: Save Where It Matters Most

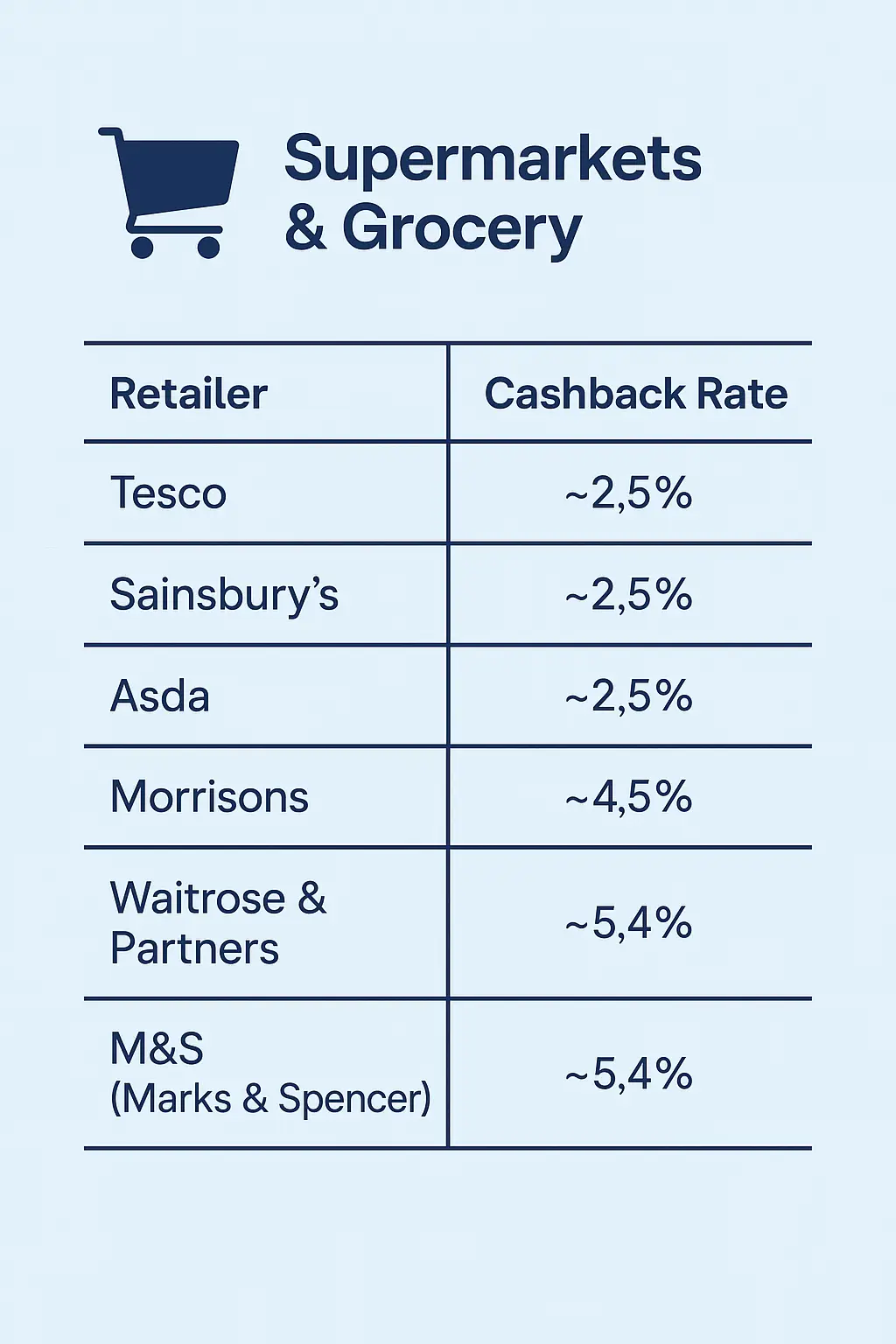

Cashback retailers: Groceries, fuel, toiletries, these are the essentials that dominate our monthly budgets. Sprive turns these everyday necessities into opportunities for savings. Major high-street names like Sainsbury’s, Tesco, and Boots frequently offer cashback incentives when you purchase digital gift cards through the app. Whether you’re topping up your fridge or fuelling up your car, those micro-rewards quickly add up. It’s not just about earning cashback, it’s about making your essentials work harder for your financial future.

Supermarkets

Dining

Fashion

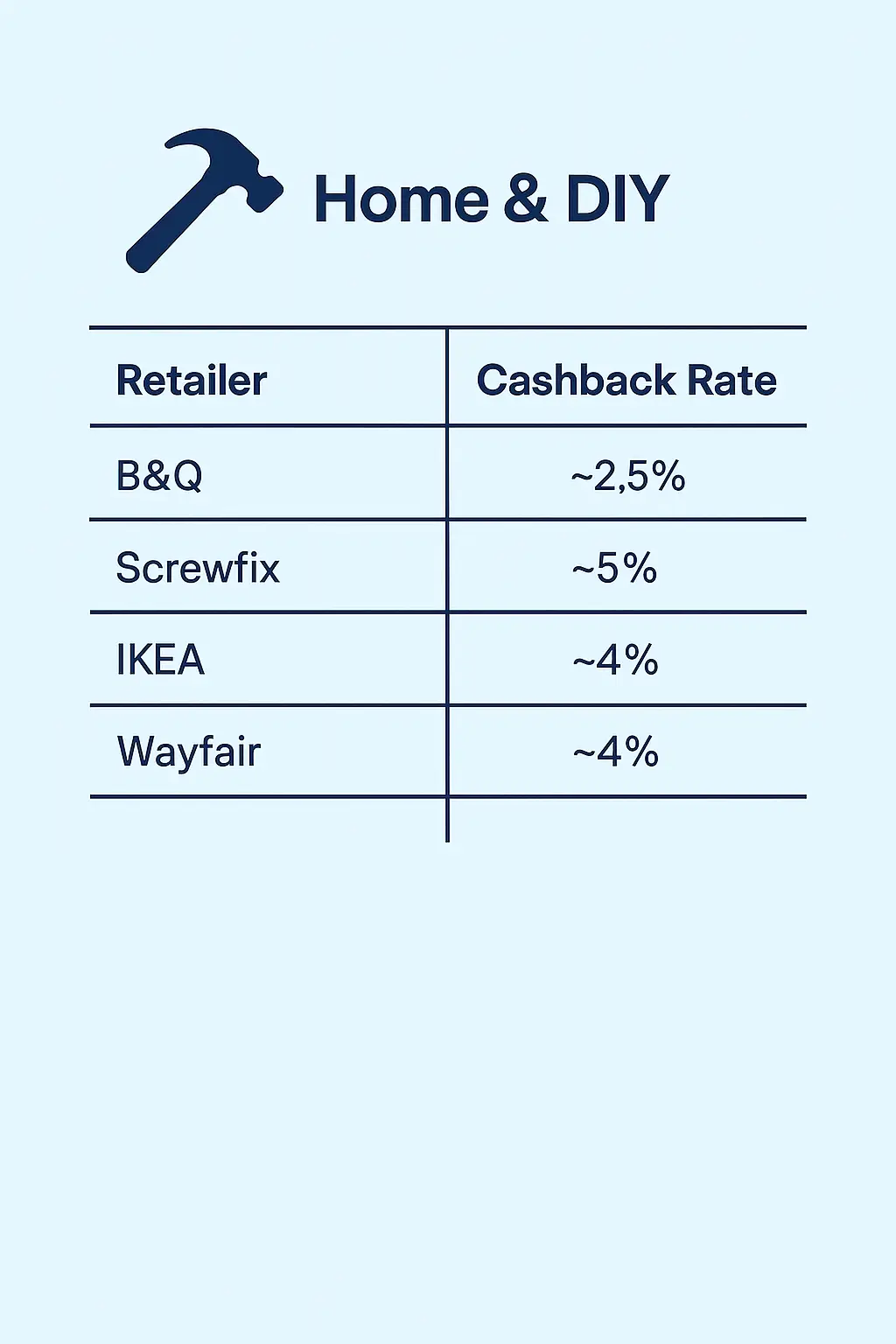

Home

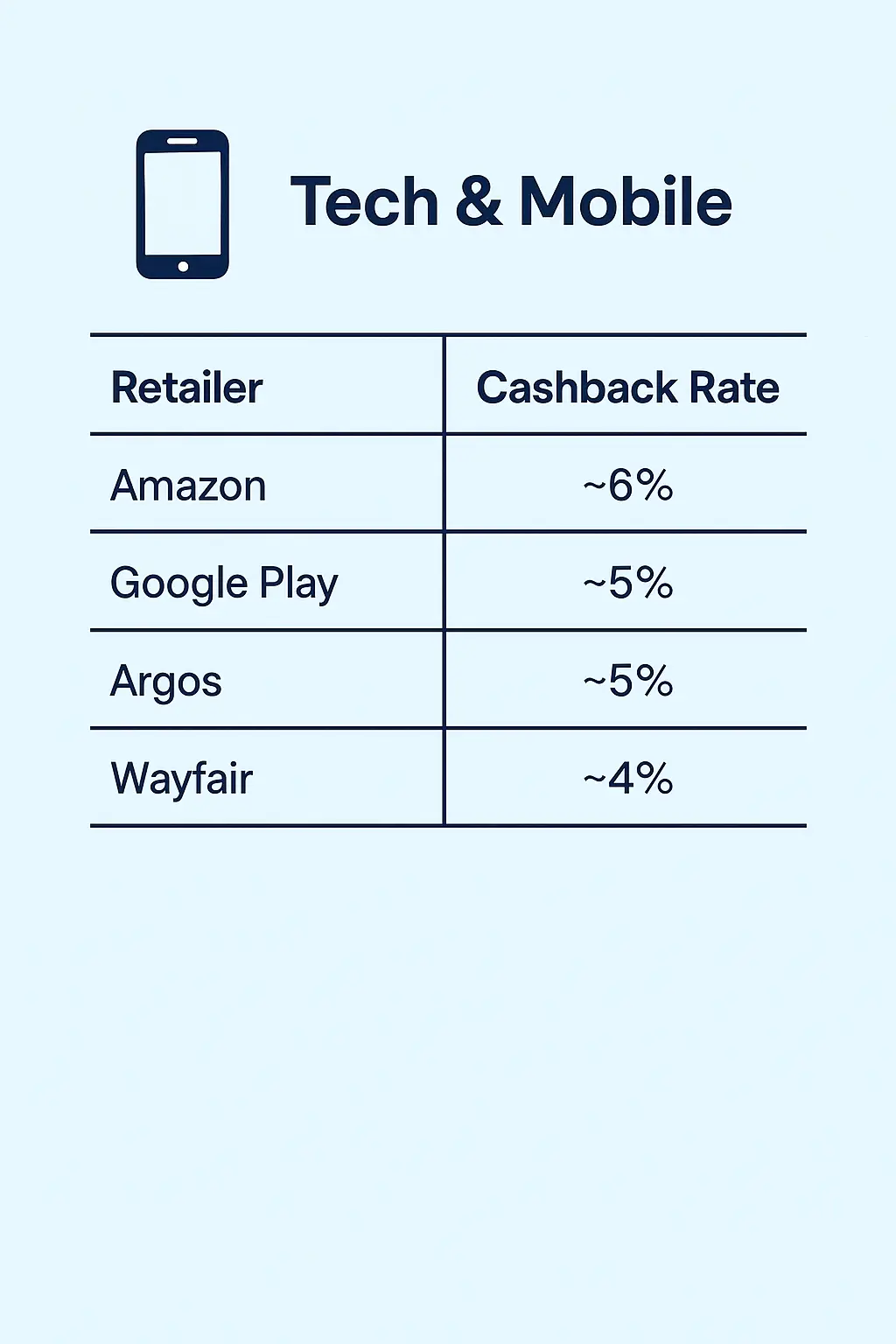

Tech

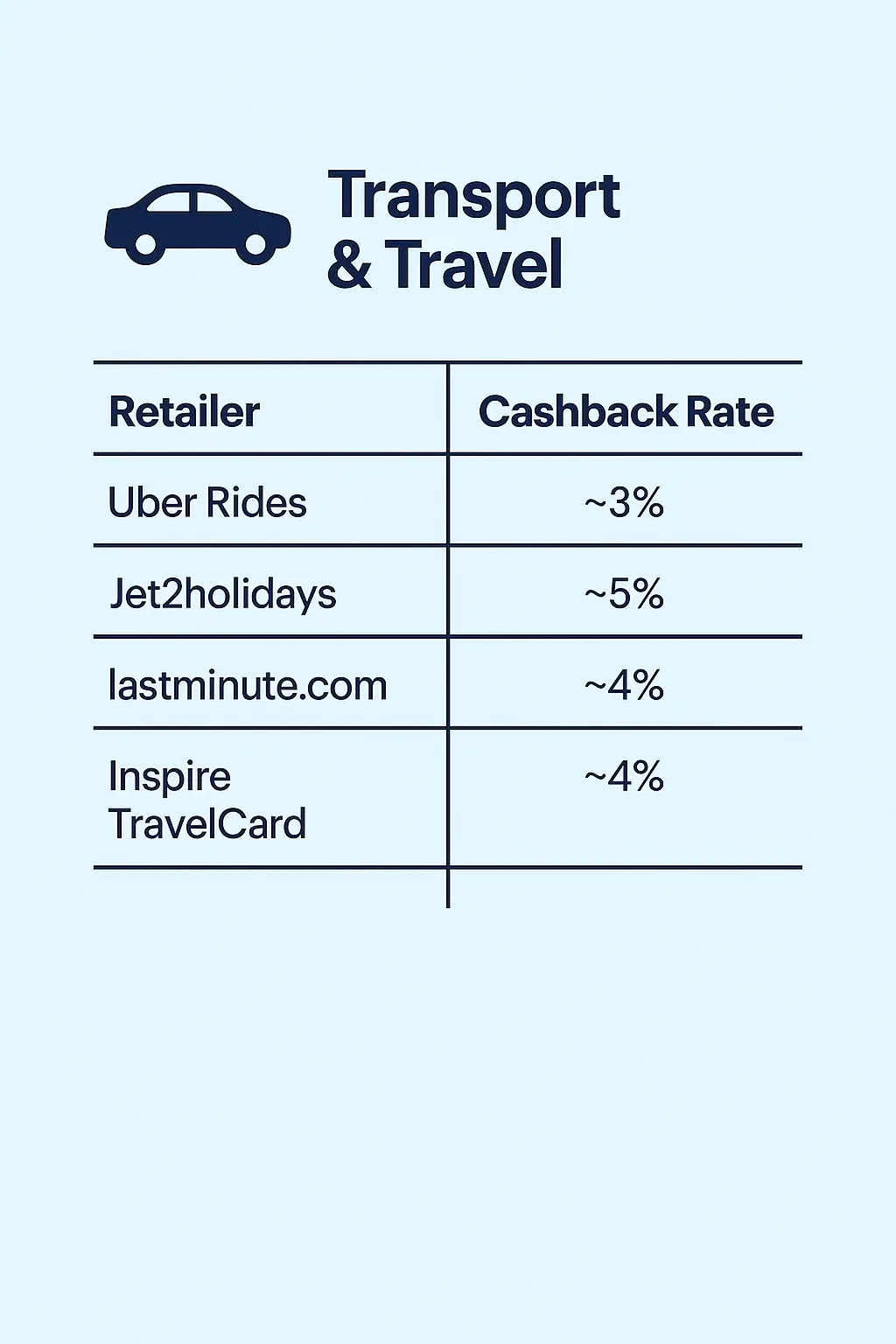

Travel

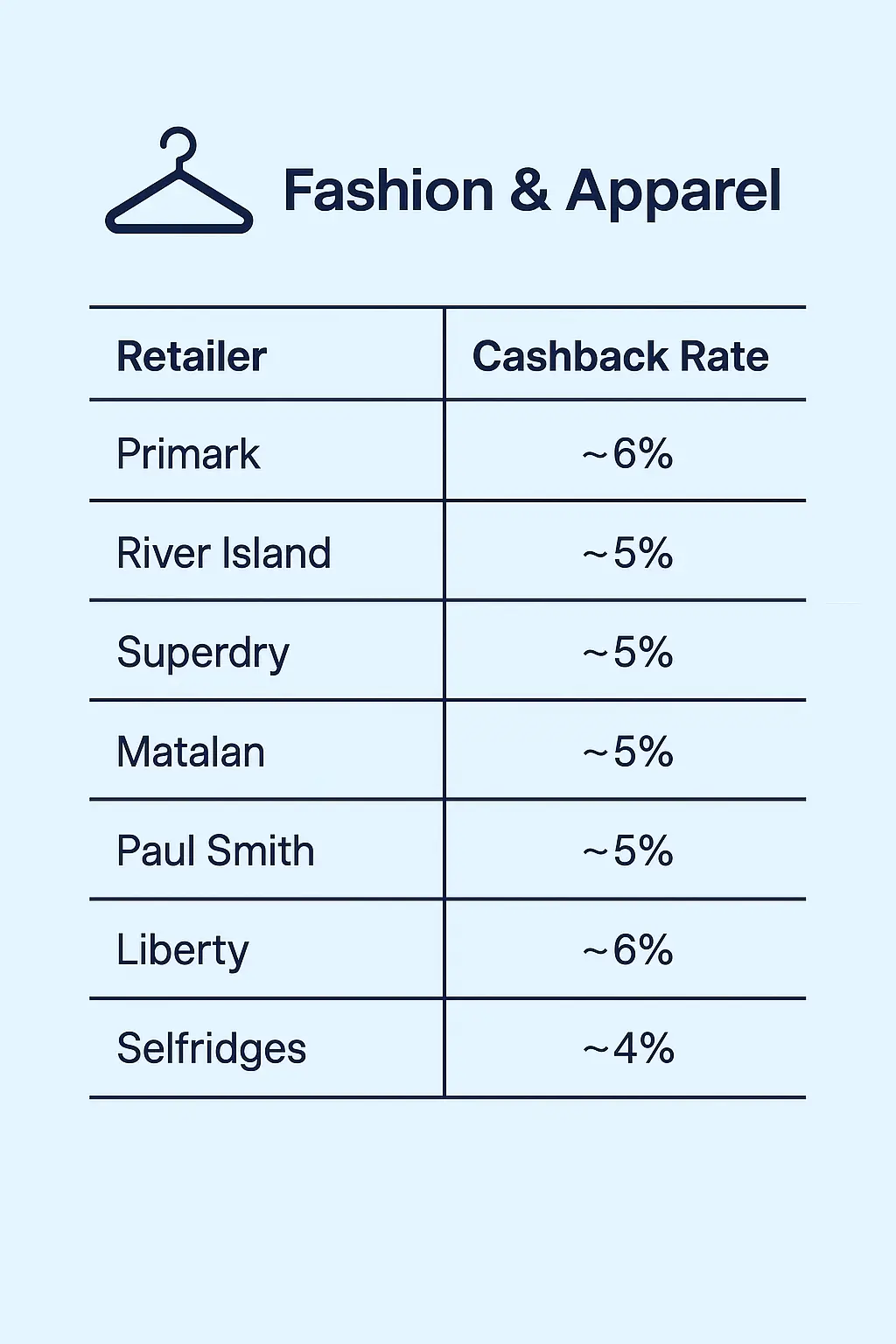

Fashion & Footwear: Style Meets Strategy

Keeping your wardrobe fresh doesn’t have to derail your financial goals. Sprive partners with popular clothing and lifestyle retailers such as ASOS, H&M, and JD Sports, allowing you to earn cashback while shopping for the latest trends. From seasonal fashion to school uniforms, your next clothing haul could directly reduce your mortgage balance, a win-win for savvy shoppers and style lovers alike.

Tech & Gadgets

Tech purchases tend to be higher-ticket items, laptops, mobile phones, smart home devices, which means they carry even more cashback potential. Retailers like Currys, Apple, and Argos often feature within Sprive’s partner list, offering users a way to offset major purchases with meaningful mortgage contributions. Planning to upgrade your home office or replace that ageing tablet? With Sprive, it becomes a strategic financial move.

Transparent Tracking & Zero Fuss

Every time you shop using a Sprive-linked gift card, the cashback is recorded, tracked, and seamlessly applied to your mortgage, no forms, no chasing. You’ll receive app notifications and clear transaction histories, so you’re always in control. For homeowners looking to boost overpayments without administrative headaches, this hands-off system is a game changer.

Smarter Spending

Sprive isn’t just about cashback, it’s about shifting the way you interact with money. With intuitive in-app tools, the platform nudges you toward better financial decisions while helping you stay motivated to reach your mortgage goals. It’s ideal for homeowners who want to take control of their future without overhauling their lifestyle.